Key Findings

Note

- ADO’s mission remains unclear and entangled with ND’s operational control.

- Strategic misalignment between ADO and ND creates friction and inefficiencies.

- Business needs are poorly documented, often Excel-based, and not aligned with long-term strategy.

- Data initiatives are fragmented, lacking cataloging, ownership, and governance.

- Technical debt and inconsistent vendor implementations undermine scalability.

- Foundational capabilities (governance, metadata, lineage) are under-prioritized.

- Over 280 isolated databases reflect extreme fragmentation and siloed ownership.

- Existing tools and platforms are rigid, proprietary, and difficult to evolve.

These findings underscore the need for a restructured operating model that centers governance, foundational capabilities, and business alignment, enabling ADO to function as a strategic, value-driven data organization.

Overview

This section summarizes the core diagnostic insights that informed our recommendations for a modern, scalable data strategy. Each finding reflects a structural or operational challenge that must be addressed to unlock the full potential of data-driven transformation at Nissan North America (NNA).

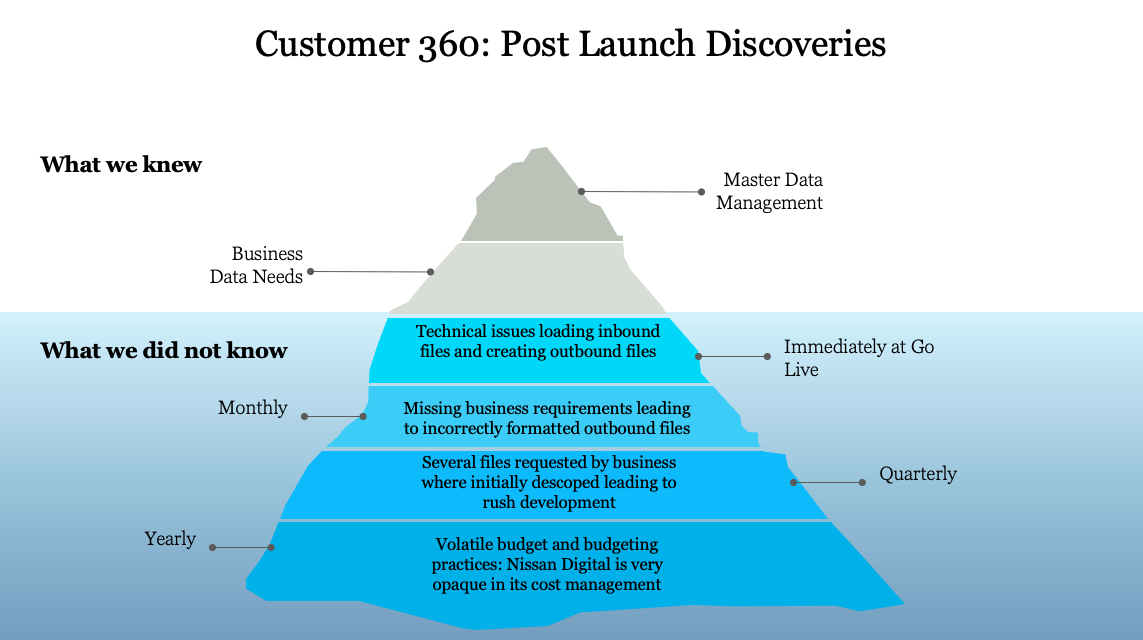

Exemple: C360

Much of the technical debt and systemic misalignment originates from legacy initiatives, lack of long-term vision, and inconsistent implementation standards.

Vendor-driven DQ and QA processes have historically resulted in poor documentation and low data quality. Key issues include:

- Multiple inconsistent customer IDs

- Varying rules for string length, character sets, and formats

- Derived spaces (e.g., C360) are overly complex, outdated, and lack constraints (PK/FK)

- CCPA compliance is still manual

- Low demographic completion and questionable accuracy

- Inconsistent volume reconciliation between DBS and C360 (e.g., sales/repair orders)

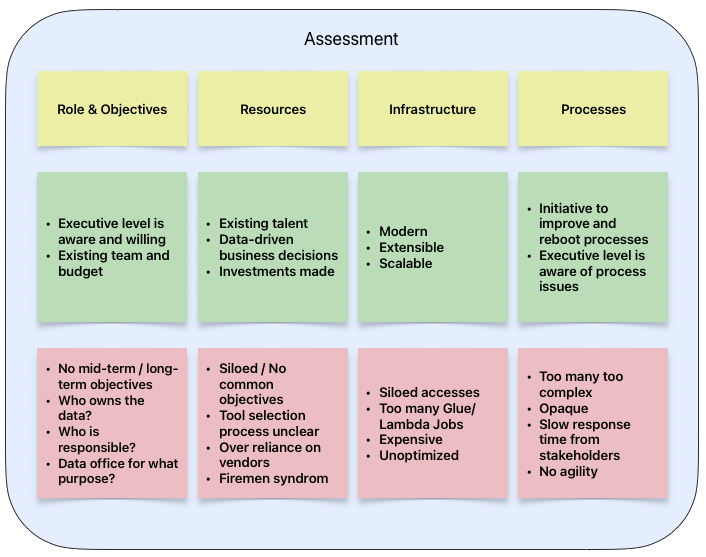

1. Lack of Clarity Between Data Functions (ADO vs. ND)

There is persistent confusion between the roles of the Americas Data Office (ADO) and Nissan Digital (ND). ADO is expected to act strategically, delivering business-aligned data products, but remains operationally dependent on ND for access, tooling, and infrastructure.

This misalignment leads to:

- Conflicting objectives

- Friction in execution

- Delayed timelines for even basic data operations

Strategic Implication: ADO must be empowered with greater autonomy and clarity of mission. Governance, access, and tool ownership need to be redistributed to reflect accountability.

2. Tactical Culture: “Fireman Syndrome”

The organization often reacts to data problems in real-time, fixing one-off fires rather than building long-term infrastructure or reusable solutions. This has led to:

- Inconsistent implementation standards

- Minimal institutional knowledge

- Over-reliance on third-party vendors

Strategic Implication: Investment must shift from reactive execution to foundational capabilities, governance, metadata, and reusability, enabling agility and innovation.

3. Business Requirements are Fragmented or Missing

Many business processes rely on undocumented, Excel-based workflows that are shared informally. As a result:

- Use cases are hard to prioritize

- Technical teams work without clear business alignment

- Scope and value are difficult to measure

Strategic Implication: A consistent intake and documentation process is needed to translate business needs into actionable data requirements, feeding both architecture and prioritization frameworks.

4. Data Governance is Undeveloped

There is no formal governance body or policy structure defining:

- Who owns what data

- How data should be managed and accessed

- What quality and compliance standards must be upheld

Some initial efforts, such as quality checks via Streamlit, are in place, but they lack scale, ownership, and strategic alignment.

Strategic Implication: Establish a centralized governance framework with clear data ownership, stewardship roles, policies, and automated controls. Open-source tools like OpenMetaData can accelerate implementation.

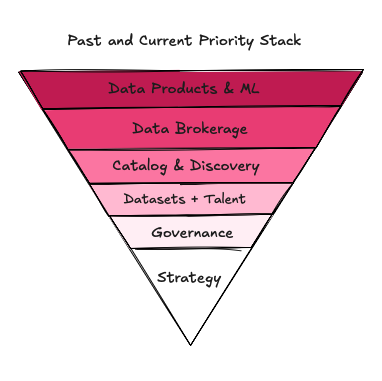

5. Inverted Data Priorities: The Upside-Down Pyramid

Current effort skews heavily toward outputs (dashboards, AI prototypes) to satisfy executive interest, while critical layers like lineage, governance, and data onboarding are neglected.

1. Current Priorities:

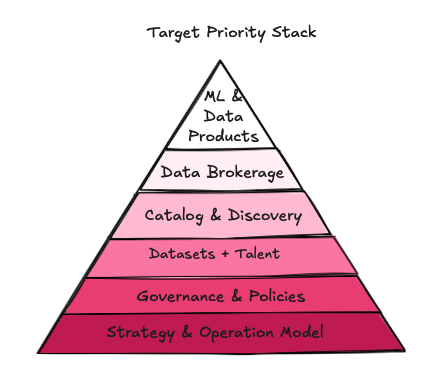

Strategic Implication: Rebalance focus toward foundational capabilities. Over 50% of effort should go toward establishing governance, operating models, reusable datasets, and cataloging, before advancing analytics and ML.

Success

The Data Office must prioritize foundational capabilities before building value-added products.

2. Recommended Priorities:

Building sustainable data products requires investing heavily in foundational pillars before reaching for analytical or predictive outputs.

3. Recommended Effort Allocation (% of Data Office Budget/Focus):

The earlier layers require more initial and ongoing effort:

| Layer | % Effort | Justification |

|---|---|---|

| Strategy & Operating Model | 10% | Ensures alignment with enterprise goals and KPI-driven execution |

| Governance & Policies | 20% | Establishes ownership, accountability, and compliance |

| Datasets & Talent | 25% | Core layer involving engineering, architecture, and data onboarding |

| Catalog & Discovery | 15% | Enables transparency, searchability, and reusability of assets |

| Data Brokerage | 15% | Handles secure, scalable data distribution |

| Data Products & ML | 15% | Final output layer; should be business-driven and built on clean foundations |

Info

~55–60% of total effort should be foundational (layers 1–3)

6. Technical Debt and Vendor Lock-In

Legacy systems (e.g., C360) and tool sprawl have created fragmentation, overlapping "golden records," and inconsistent ETL logic across environments. Key issues include:

- Redundant customer ID schemas

- Poor adherence to PK/FK integrity

- Manual CCPA compliance processes

- Differing string/formatting rules causing data rejection or truncation

Two major initiatives were launched to centralize and manage data assets:

However, data ingestion and transformation pipelines were outsourced to various vendors (Maritz, Lumen, CGI, TechM, Globant), leading to inconsistencies in documentation, ownership, and long-term sustainability.

Strategic Implication: Rationalize the stack with a hybrid architecture. Replace proprietary tools where feasible with open-source solutions (e.g., dbt, Airbyte, Superset), and standardize MDM using a layered TCA schema (Technical, Canonical, Analytical).

7. No Unified Data Catalog or Discovery Process

Although initiatives like OSS and the RDO Catalog exist, discovery remains manual and inefficient. Employees often depend on tribal knowledge or repeated interviews to find and reuse datasets.

Strategic Implication: Invest in a user-friendly, open cataloging tool with clear ownership metadata and business glossary integration. Enable easy discovery and promote reuse.

8. Over 280 Isolated Databases – Data Without Direction

An internal audit identified more than 280 databases, highlighting the extreme fragmentation of NNA’s data estate. These are often:

- Isolated to business units

- Duplicative in nature

- Unconnected to broader enterprise use cases

Strategic Implication: Centralize control and curation under a shared governance framework. Enable federated architecture, but with enterprise visibility and reuse standards.

9. Data Architecture Recommendations

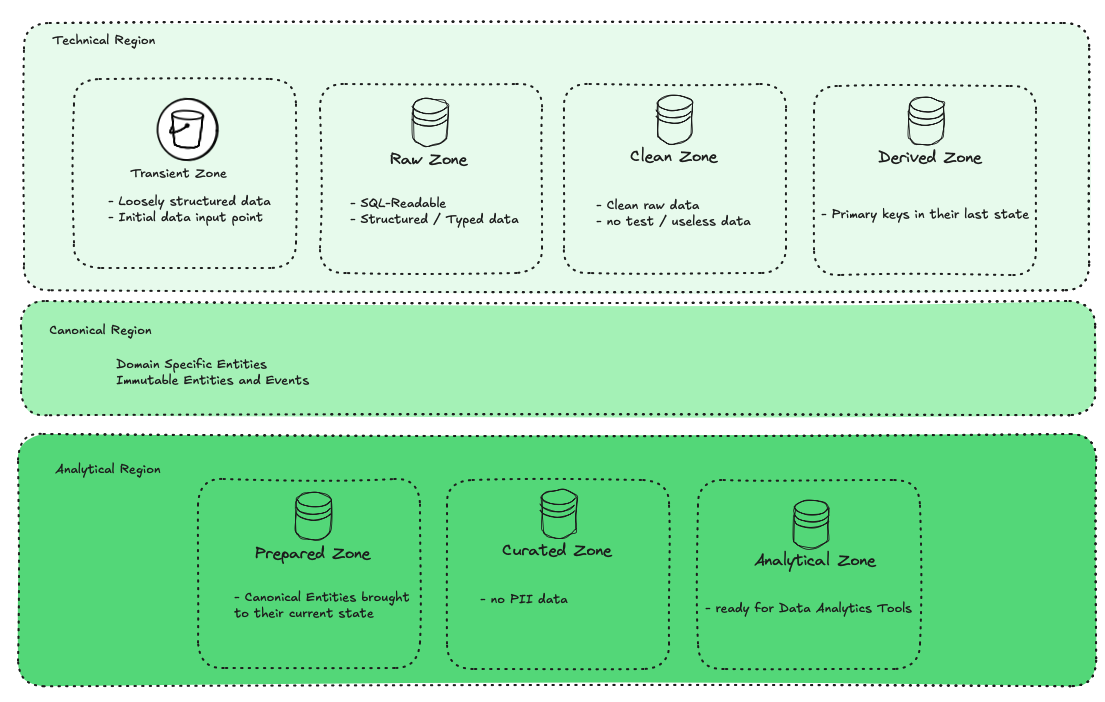

To support sustainable outcomes, we propose implementing a layered data architecture that distinguishes between:

- Technical Layer – Raw data ingestion, ETL, observability

- Canonical Layer – Standardized entities, shared vocabularies

- Analytical Layer – Domain-specific marts, enriched data products

This TCA schema improves traceability, modularity, and scalability across all data products.

Summary

These findings reflect not isolated problems, but patterns, systemic gaps in governance, ownership, tooling, and cultural mindset. The recommendations that follow are designed to directly address these challenges and build a modern, agile, business-aligned data function for Nissan North America.